The Mayor of New York, Bill de Blasio, has ordered an immediate investigation into the tax reports of President Donald Trump. The Mayor stated that the president has defrauded the city by evading the payments of millions of dollars in taxes. The Mayor’s statement is coming after a report published in The New York Times on Sunday stating that the president only paid $750 in income tax in 2016 and 2017. The paper also revealed that Trump did not pay federal income taxes in at least 10 out of the last fifteen years.

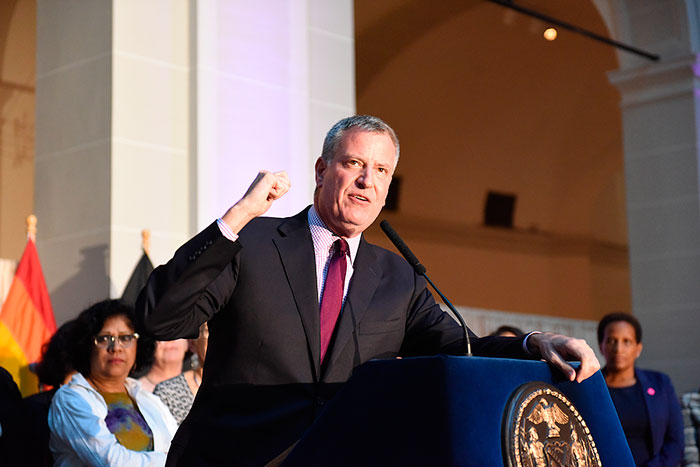

“I believe we can ascertain from the New York Times report that the president has defrauded his hometown, New York City, by not paying taxes,” Mayor de Blasio said. “The finance department has been tasked with investigating the claims and I strongly believe we should expect the worst based on everything the president has done.”

The president has reacted to the report by stating that the news is fake, but is yet to point out the truth or show any evidence. The New York Times stated that Trump paid $95 million in 18 years but recovered $72.9 million as a federal tax return. Trump also received a $21.2 million refund from local and state taxes according to the newspaper. By calculation, the president has only paid about $1.4 million to the IRS from 2000 to 2017 while the average top taxpayer-paid almost $25 million every year from the same 2000 to 2017.

The paper also speculated that the president’s exorbitant spendings have been funded by his business expenses. His homes, golf courses, and airplanes have been categorized as being a part of his business expenditures. This has helped Trump evade millions in taxes. The paper also reported that a lot of the president’s investments have been raking in losses and not profits. The paper stated that the politician and businessman has lost almost $400 million on his golf courses and the Trump International Hotel in Washington.

The Times reported that the bulk of Trump’s properties are being financed by governments of other countries, politicians, and lobbyists. The paper reported that Trump made $3 million, $2.3 million, and $1million respectively from projects in the Philippines, India, and Turkey. All these will one day result in substantial debts for the president. The paper cited $421 million unpaid loans and $100 million mortgages on the Trump Tower both due within the next four years.

The president and the First Lady in September 2019 changed their main residence from New York to Florida. This change was reported as a result of Florida’s lack of income or inheritance tax. After the documentation of the switch in residence, the president stated he left New York because the city’s leaders were hostile towards him. The president also stated that though New York is expensive, he doesn’t mind paying the taxes.

The Times also included the income, losses, tax refunds, and sums paid in taxes by the president. The report says that Trump made a total of $197.3 million from The Apprentice, $230 million in endorsements, $178 million from some of his investments, and 72. 9 million tax refunds. The losses the president recorded include $1 billion from his Atlantic City casino, $315.6 million from his golf courses, and $65.5 million from his hotel in Miami.

The president, according to the Times report, paid over $70 million between 2005 and 2008 in federal tax for his income from endorsements and The Apprentice. The president reportedly owes about $300 million in loans due in the next four years. According to available financial records, the president has liquidated hundreds of millions of his stocks and has less than $1 million in his portfolio.

Source: dailymail.co.uk